7.30.2015

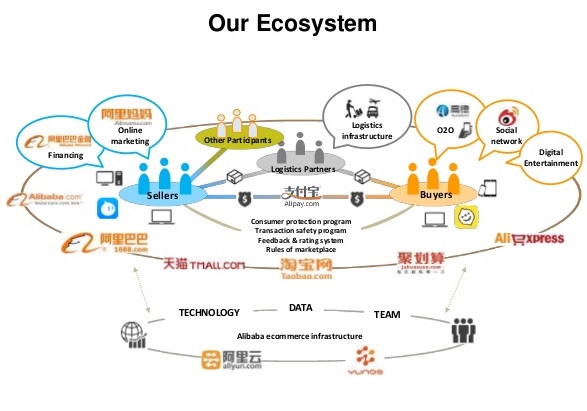

Above: If this is an abstraction of supply chain relationships/dependencies, where might the most risk reside?

From the World Economic Forum's 2012 paper, New Models for Addressing Supply Chain and Transport Risk:

Global supply chains and transport networks form the backbone of the global economy, fueling trade, consumption and economic growth. Trends such as globalization, lean processes and the geographical concentration of production have made supply chain networks more efficient, but have also changed their risk profile. Most enterprises have risk management protocols that can address localized disruptions. However, recent high-profile events have highlighted how risks outside the control of individual organizations can have cascading and unintended consequences that cannot be mitigated by one organization alone.

It is not just concentration of production. Concentration is a feature of almost every level of the supply chain and, originates in concentration of demand within increasingly dense urban conglomerations. Demand concentration facilitates other sorts of concentrations. Walmart, Costco, Lowes, Home Depot, Liquor Barn and similar retail strategies concentrate a wide array of products in very close proximity to serve demand. These demand "attractors" are served by large distribution or fulfillment centers that are increasingly clustered around the same transportation networks. Economies of scale support product diversity, considerable convenience, and competitive pricing.

Soon: Will the supply concentration strategy be superseded by a capacity for"mass-customization"?

7.29.2015

Above: Green shows Indianapolis food deserts in 2014, by Indiana Public Media.

Last year at least one analysis found Indianapolis to be the US metro area with the most population living in a "food desert".Last week the Indy empty zone got a bit bigger when four long-time grocery stores serving low-income areas suddenly closed.

According to Walk Score seventy-two percent of New Yorkers live within a five minute walk of a grocery outlet with healthy options. Only five percent of Indianapolis residents live within a five minute walk.

Four Double 8 stores had served northern Indianapolis for over a half-century. They closed -- seemingly collapsed -- without much warning. I'm guessing (and that's all it is) that they lost a line-of-credit either with their bank for payroll or with their supplier for products. They had been trying to sell the stores -- without success -- for a time.

The owner/operator of Double 8 pointed to new competitors within a quick drive. The competitors are banners of much bigger chains. While once-upon Double 8 customers told reports that the small chain offered quality products and low prices, the bigger chains can meet the price-points and offer a more diverse range of products, including pharmacy, gasoline, ready-to-eat and more. In most American cities -- unlike New York -- the hassle associated with driving several more blocks is not sufficient to discourage direct competition across almost any 25-to-30 square mile quadrangle. If you have a working vehicle.

Grocery is a very price-sensitive, low margin business. It is therefore typically a high-volume business. In one-way or another grocery -- and other suppliers -- play different kinds of concentration strategies in order to compete. Any sustained loss of volume endangers the enterprise. Double 8 told reporters sales had decline by "double-digits" over the last year.

Next time: More on concentration strategies.

Last year at least one analysis found Indianapolis to be the US metro area with the most population living in a "food desert".Last week the Indy empty zone got a bit bigger when four long-time grocery stores serving low-income areas suddenly closed.

According to Walk Score seventy-two percent of New Yorkers live within a five minute walk of a grocery outlet with healthy options. Only five percent of Indianapolis residents live within a five minute walk.

Four Double 8 stores had served northern Indianapolis for over a half-century. They closed -- seemingly collapsed -- without much warning. I'm guessing (and that's all it is) that they lost a line-of-credit either with their bank for payroll or with their supplier for products. They had been trying to sell the stores -- without success -- for a time.

The owner/operator of Double 8 pointed to new competitors within a quick drive. The competitors are banners of much bigger chains. While once-upon Double 8 customers told reports that the small chain offered quality products and low prices, the bigger chains can meet the price-points and offer a more diverse range of products, including pharmacy, gasoline, ready-to-eat and more. In most American cities -- unlike New York -- the hassle associated with driving several more blocks is not sufficient to discourage direct competition across almost any 25-to-30 square mile quadrangle. If you have a working vehicle.

Grocery is a very price-sensitive, low margin business. It is therefore typically a high-volume business. In one-way or another grocery -- and other suppliers -- play different kinds of concentration strategies in order to compete. Any sustained loss of volume endangers the enterprise. Double 8 told reporters sales had decline by "double-digits" over the last year.

Next time: More on concentration strategies.

7.28.2015

Above: Map of food deserts by USDA

Three different cities each with a similar story, all reported in the last few days:

From the July 22 Baltimore Sun:

With one in four Baltimoreans living in a food desert, city officials have a long road ahead to deliver on promises of healthy, affordable and accessible food options. One of the city's approaches follows a tried-and-true roadmap that involves offering incentives, like tax breaks for locating in underserved areas, to retailers and developers — also known as "fresh food financing." Created over the last decade, these types of incentives work; in Philadelphia, the number of people living in food deserts was cut by 56 percent this way, for example. There is a simpler, less costly solution under consideration, however: changing when food stamps are distributed.

From the July 25 Los Angeles Times:

Filipinotown is a food desert, a neighborhood high in fast-food joints and low in grocery stores and healthful eating options, said Ignacio, the project leader for the Asian and Pacific Islander Obesity Prevention Alliance.

From the July 24 Springfield, Missouri News-Leader:

When we look at the food desert in Springfield, it certainly doesn’t mean everyone in that area has limited access,” said Mooney. “Really, Springfield is a town where, if you have a car, you can get to where you’re going.” However, for those who don’t have access to a car, food — especially fresh, healthy food — can be very difficult to get their hands on. To build his food-desert map, Mooney plotted “qualified food stores,” which means full-size grocery stores, and drew half-mile circles around each. Any census tract that qualified as low income and didn’t touch the circle surrounding a grocery store was marked as having low access.

In the same week there were very similar reports on food deserts in Indianapolis, Duluth, Portland, Oregon, Chattanooga, and rural West Virginia.

Next time, some discussion.

7.26.2015

Above: By Khan and Estay in Technology Information Management Review

Writing in the recent CSCMP Supply Chain Quarterly, Drew Smith explains:

The flexibility, scalability, and efficiency of the technology that enables information sharing has created additional points of access to an organization's proprietary information, increasing the risk that the corporate knowledge that drives profitability may fall into the wrong hands. Particularly vulnerable are those processes and activities that involve the sharing of information between external supply chain partners.That is why supply chain managers must play a larger role in cybersecurity—the measures taken to protect a computer, computer network, or data from unauthorized access or attack. They need to be aware of what the risks are and of which areas of their supply chain may be vulnerable to cyberattacks. And they must make sure that not only their own company but also their suppliers are following best practices in cybersecurity.

I have been absent from this blog while attending the annual Aspen Security Forum. I seemed to be the only supply chain jockey at the session. But cyber certainly got a lot of attention (regarding which I have provided a summary at Homeland Security Watch). It is clear that many perceive we are already engaged in cyber-wars that will get worse in the years ahead.

One of the reasons I was in Aspen is the judgment of some that "supply chain will be the next cyber," in other words, supply chain already is -- and will soon be recognized as -- a crucial national security issue. Partly this is because cyber is mostly a means to certain ends... which, among others, involve supplying Americans with the water, food, pharmaceuticals, and other necessities to survive.

7.22.2015

In the midst of a long-term drought, the flooding of a former hurricane has taken out a bridge on eastbound Interstate 10 between Los Angeles and Phoenix, about 40 miles west of the Arizona state line. The westbound bridge still stands, but was compromised beyond safe use.

Caltrans reports that over 27,000 vehicles typically travel this route each day, including a significant number of long-haul trucks. No easy detour is available. Most trucks will add at least 80 miles one-way.

Transportation officials intend to strengthen and reopen the westbound bridge to two-way traffic within "weeks, not months".

On Friday J.B. Hunt Transport Services reported revenue-declines resulting in part from,"the lingering effects of disruptive shipping patterns due to the West coast port issues that plagued retailers at the beginning of the year." Closure of the I-10 will exacerbate the problems for Hunt and other transporters.

Meanwhile, Congress is struggling to resolve systemic and political issues related to the federal transportation bill. Mostly funded by gasoline taxes, funding has slipped as gasoline demand has fallen, "Unable to agree on another funding source, lawmakers have passed 34 short-term extensions since 2009 that have kept transportation programs teetering on the edge of insolvency."

The current funding program expires on July 31.

7.21.2015

Above: The status of US aquifers overtime from the US Geological Survey

As reported in Water Resources Research, sources of groundwater are being consumed at unsustainable rates in twenty-one of the world’s 37 largest aquifers. According to an analysis of NASA data published last week, more water was removed than replaced during a decade-long study period. Underground aquifers supply 35 percent of the water used by humans worldwide.

In the Sunday New York Times it was projected that Arizona's demand for water will exceed supply in less than ten years. The current California drought is not unprecedented. The current level of demand for water is unprecedented.

According to the 2015 World Water Development Report:

Global water demand is largely influenced by population growth, urbanization, food and energy security policies, and macro-economic processes such as trade globalization, changing diets and increasing consumption. By 2050, global water demand is projected to increase by 55%, mainly due to growing demands from manufacturing, thermal electricity generation and domestic use.

In my supply chain work I always include water. Most others treat it as "Critical Infrastructure". Water systems are typically below (infra) ground. Water is certainly critical. But there is a tendency to perceive infrastructure as a "facility" that can be engineered, managed, protected and, if necessary, recovered.

Supply chain analysis -- especially as the ecosystem concept is adopted more widely -- is attentive to reliable sources and demand patterns. An infrastructure can be efficient and resilient, but if supply is insufficient and/or demand is excessive, no facility will be sufficient.

7.20.2015

Above: A view of the Supply Chain "commons" by the Association for Healthcare Resource and Materials Management

Mutuality is one approach to managing strategic risk across supply and demand networks (see prior posts). In the United States, collaboration is probably more often used to describe similar behavior. But the two concepts are not identical.

Mutuality implies innately interdependent relationships. Collaboration suggests something more voluntary. Collaboration is typically opportunity-oriented. A strategy of mutuality is much more likely to give serious attention to shared risks. A strategic relationship featuring significant collaboration may actively seek to minimize mutuality. A strategic relationship characterized by substantive mutuality may involve otherwise fierce competitors.

Mutuality has an especially long and rich history in the insurance industry. There may be important analogies for mutuality among supply chain players.

David Wilkie explains:

Mutuality is the normal form of commercial insurance, whether or not it is run by a mutual insurance company or one owned by shareholders. Applicants contribute to the pool through a premium that relates to their particular risk at the time of the application, perceived as well as it can be at that time on the basis of all the facts that are available and relevant, with or without application to any astrologers. The pooled funds then pay those insured who suffer losses in accordance with the scale of their losses for things like fire, household and marine insurance, or in accordance with the agreed sum assured for life insurance.

Supply chain collaboration is often focused on generating greater efficiency. Mutuality may do this too, but it does so from a risk-informed position. Further, at least in my fevered brain, when I hear mutuality I immediately think of solidarity.

David Wilkie again:

Solidarity is a concept that has some similarity to mutuality, but also a profound difference. The similarity is that losses are paid according to need, and the difference is that contributions are made not in accordance with the risks that each applicant brings in with him, but perhaps according to ability to pay, or just equally.

Many contemporary supply chains - especially those serving dense urban environments - are mutually dependent on electricity, telecommunications, fuel, continuity (and integrity) of pull signals, trucks, truckers, and more. While individual supply chain participants may "bring in" differentiated risk, most share a very similar risk profile, especially in regard to catastrophic possibilities.

Solidarity effectively describes systemic risks to supply chains. Mutuality describes a potential -- but today, underutilized -- approach to mitigating these systemic risks. To participate in mutual efforts to prevent, reduce, and mitigate risk, supply chain participants need to recognize more fully how much they depend on the "commons" they have co-created over the last generation.

7.17.2015

Mars is one of the largest buyers and processors of cocoa. To sustain its business the company has identified five principles to guide its strategy and operations:

- Quality

- Responsibility

- Mutuality

- Efficiency

- Freedom

Oxford University faculty and researchers are working with Mars to implement mutuality across its supply chain. A recent report in The Guardian claimed that, "Oxford’s researchers will challenge Mars to think about being a mutual business in the broadest sense. It will look at sharing the benefits of the business with suppliers, customers, communities, future generations - and even the planet as a producer."

[Above are the Japanese characters for keiretsu -- a headless combine, group of firms, a system of queues -- one popular description of Japanese commercial connections that encourage (some would argue, exploit) mutual dependence.]

[Above are the Japanese characters for keiretsu -- a headless combine, group of firms, a system of queues -- one popular description of Japanese commercial connections that encourage (some would argue, exploit) mutual dependence.]

7.16.2015

Social media has not been positive. Criticisms and complaints abound.

But both Amazon and third party sources seem to agree the promotion significantly increased traffic.

From TechCrunch:

Once the app is installed, the likelihood of a return visit -- and purchase -- is significantly increased. Once Amazon Prime is purchased, continued buying is seriously incentivized.

This is, among other things, a major supply chain play. Prime perquisites, such as free shipping, are sustainable as the Amazon fulfillment network is optimized. Especially in dense urban environments there is underutilized supply capacity to deploy at low marginal cost.

There is also evidence accumulating that Prime has been especially effective in driving third-party-sales, which benefits Amazon without increasing inventory cost.

Supply and demand networks are optimized by "owning" the demand channels in such a way that consumer patterns can be anticipated and effectively influenced.

Mars, the US food processing company, has initiated a supply chain sustainability effort that starts with over five million cocoa farmers and promises to deliver a "holistic program from farm to factory."

Several factors motivate these -- and similar -- significant investments. "Understanding where food comes from is a priority for consumers,” is the explanation Cargill gives. Safe and fair sourcing is an increasingly important competitive attribute across the food sector. But for many food processors it is also a mechanism that can be leveraged to better understand and influence the strategic horizon for supply.

In the case of cocoa, while demand is sky-rocketing, production has actually been declining. How can different participants in a product's commercial ecosystem collaborate to better match supply with demand?

7.15.2015

The term "supply chain" is not going away. But it is widely recognized as insufficient -- even subtly misleading. Chains consist of links. Where and when links are strong, a chain can pull supply to demand or customers to sellers.

Multiple overlapping chains pulling in various directions should be a recipe for deadly tangles (or tight controls). But the exploitation of multiple overlapping supply and demand relationships is crucial to the efficiency and effectiveness of contemporary supply chains.

An ecosystem is commonly defined as a group of interconnected elements, formed by the interaction of a community of organisms with their environment. The health (or not) of an ecosystem is a function of the interactions of uncoordinated and mostly uncontrollable behaviors that are, nonetheless, mutually dependent.

Logistics was -- often still is -- about keeping the chains tight and oiled. Supply Chain Management is about awareness and influence within webs of relationship.

[More on the graphic shown above at Dion Hinchcliffe's blog]

7.14.2015

Late last year the Journal of Business Logistics published a piece by Christopher Craighead (Penn State), David Ketchen (Auburn University) and Russell Crook (University of Tennessee) arguing that persistent and accelerating disruption has transformed supply chains into supply ecosystems. (See immediately prior post for reference to the the "Walmart retail eco-system".)

Craighead, Ketchen, and Crook write, "We define a supply ecosystem as a set of interdependent and coordinated organizations that share some common adaptive challenges and that collectively shape the creation and nurturing of a sourcing base that contributes to competitive advantage and superior performance.”

According to the authors, the three key implications of the shift toward ecosystems include:

- Co-opetition”: The term “co-opetition” refers to the simultaneous competition and cooperation. Though each member of the ecosystem is inextricably linked, they also compete with each other for resources.

- Pursuit of dual goals for the creation of value: Though each member of the ecosystem’s goal is still to create its own value, it must also consider the good of the ecosystem. As the authors wrote, “(A) firm’s goals must sometimes be sacrificed for the greater good of the ecosystem.”

- Common knowledge- and skill-base: Competencies that are shared across the ecosystem will benefit all member firms.

Supply Chain Resilience: Diversity + Self-organization = Adaptation.

7.12.2015

A quick blurb from a recent post at the Walmartlabs blog:

Walmart has implemented a pilot program called the Product Content Collection System (PCCS) that will facilitate the supplier sending their catalog directly to us. The crux of the PCCS program is a specification (a set of instructions including the list of attributes, requirement level, data transfer protocol) that will be provided to the supplier to use as a framework for sharing this data with Walmart. We are encouraging suppliers to provide us with a product content for their entire catalog, whether or not it is currently carried within the Walmart retail eco-system.

This Walmart-specific process is enabled by the emerging Global Data Synchronization Network (GDSN). See graphic above. Currently this is a business-to-business exchange, but will eventually support much greater transparency to the consumer.

Next a bit more on that throw-away reference to the "Walmart retail eco-system".

7.11.2015

Several recent surveys and studies report similar -- very high -- levels of concern related to supply chain risk.

The World Economic Forum's 2015 Global Risk Report notes, "The far-reaching global supply chains set up by multinational corporations are more efficient, but the complexity and fragility of their interlinkages make them vulnerable to systemic risks, causing major disruptions."

The insurance firm FM Global defines resilience itself, "as a combination of the vulnerability of a country to supply chain disruption and the country’s ability to recover from such disruption." The FM Global 2015 Resilience Index treats the United States as three mega-regions each with different scores on the resilience index. Only the central United States ranks in the top ten of the world's most resilient (at number 10).

A survey of corporate procurement officers by the British tech firm Xchanging (graphic above) found that potential supply chain disruption and corruption is, by far, their principal worry.

This prospective concern regarding supply chains reflects recent experience. According to BSI (British Standards Institution) in calendar year 2014 business losses due to supply chain disruption increased again. Over $32 billion in losses were generated by the top four natural disasters alone.

Shereen Abuzobaa, Commercial Director at BSI Supply Chain Solutions said, "Our experience shows that while companies are aware of and test for internal risks, they are failing to map or assess risk effectively across their supply chain. More often than not, only the first tier of suppliers is considered with no thought given to those further down the supply chain."

Linda Conrad at Zurich Insurance Company says, "Research shows about 40% of supply chain disruptions involve problems that occur at suppliers that are below tier one. We find that most people don’t have a lot of information down the tiers or even what their potential business interruption is should something go wrong.”

7.09.2015

A Wall Street Journal piece describes, "how digital business disrupts the supply chain." The same information could be characterized as, "how digital business matches supply and demand."

Point-of-sale is being revolutionized. It's not just digital capture at retail stores and online. It is a vector relationship of the time-of-sale, variable pricing, technology involved, social context, prior purchasing behavior, intentional influence, and much more. What was once an inventory-management signal has become -- in combination -- a strategic management signal.

The WSJ highlights three key characteristics of "digital business"

An increased number of network nodes. As devices become more self-aware and communicate with their ecosystems, new possibilities are opened for the supply chain. Many more enterprise assets will describe availability, capacity and health, while inventory—such as perishable goods—can be located and even its freshness determined. Real-time availability of more granular data will improve decisions for planning, allocation, optimization and service.

Automated judgment. Making human decisions from the abundance of data available will be overwhelming, requiring nonhuman intervention for faster decisions and to also ensure human resource capacity is available to think strategically.IBM Corp.'s Watson and Google Inc.’s Nest Labs demonstrate two ends of the spectrum for self-learning and automated judgment, ranging from advanced science to home energy management. Supply chain nonhuman customers will decide where and when they need product or how best to use capacity.

Cyber risk increases for operational technology. As operational technology, OT, devices connect to the Internet they are more exposed than in the past. This will require a convergence with how IT is managed.

I will add one more: Potential benefits tend to be self-optimizing. Those enterprises that are early-and-effective adopters have an amplified advantage versus competitors who do not have similar visibility into the market.

7.08.2015

Until the last thirty years supply was almost all push. Farmers, fabricators, and their trading partners mostly guessed about the size and location of demand. Products were pushed toward supposed demand... often resulting in either feast or famine.

Today demand signals increasingly pull supply. But even with the advances of the last generation there remains a great deal of dependence on push.

Late last year the Gartner consulting group found that the "average" consumer product company had an error rate of 21.9 percent on forecasting SKU-level demand one month out. For new products the average error rate rose to 48.3 percent. Intuition can be about as good.

Even well-above-average performers were off by at least 11 percent on most products and 34.7 percent for new products. Given these gaps, procurement -- and even more, sourcing and production -- typically continue heedless of projections.

Supply networking differs from logistics most when demand information drives value across the whole source-to-consumption continuum. There is still a long way to go in terms of accessing and assessing demand data then building supply processes around the pull signals.

Today demand signals increasingly pull supply. But even with the advances of the last generation there remains a great deal of dependence on push.

Late last year the Gartner consulting group found that the "average" consumer product company had an error rate of 21.9 percent on forecasting SKU-level demand one month out. For new products the average error rate rose to 48.3 percent. Intuition can be about as good.

Even well-above-average performers were off by at least 11 percent on most products and 34.7 percent for new products. Given these gaps, procurement -- and even more, sourcing and production -- typically continue heedless of projections.

Supply networking differs from logistics most when demand information drives value across the whole source-to-consumption continuum. There is still a long way to go in terms of accessing and assessing demand data then building supply processes around the pull signals.

7.07.2015

Modern supply networks are widely dispersed, complex, and constantly morphing. Today very few supply chain participants are well-informed regarding who does what where in order to deliver products on time.

The Modern Slavery Act and the California Transparency in Supply Chains Act are but two of several legal and regulatory provisions that are emerging to require greater awareness and accountability for safety, sustainability, and ethical practice across whole networks.

Risk resilience is very seldom referenced as a goal of these provisions. But the tracking and auditing capability needed to achieve these other purposes will also support a better understanding of innate network risk.

Sourcemap (visual above) is one of several new players -- or long-time players with new capabilities -- offering tools to allow supply chain operators to precisely capture sourcing, processing, packaging, distribution and more.

Sourcemap promises to "identify the weakest link in your supply chain automatically through inventory mapping and TTR (time-to-recover). Receive automated alerts on disruptions affecting your suppliers. Measure your supply chain against risk probability heat maps."

But here's the issue: visualizing major supply chains is analogous to visualizing weather or other complex entities. It can be done. But accuracy will vary. Complexity allows for probability assessments, not precise prediction.

7.06.2015

Several studies in recent years have tracked a narrowing manufacturing cost-gap between China and the United States. A recent analysis by the Boston Consulting Group and Michael Porter at the Harvard Business School finds that overall this gap is now within five percent. (Wider gaps exist between the US and other developing economies, eg Indonesia or Vietnam.)

When combined with much lower US logistics cost, there is now a comparative advantage for many products to be made-and-delivered in the United States, This advantage is amplified for innovative products where speed-to-market is a crucial competitive factor.

But is the US on the edge of forsaking this advantage? As previous posts suggest, even as density and increasing fidelity of demand signals enhance the potential for supply efficiency, outdated infrastructure and underdeveloped human capital complicate what could be the foundation for a renaissance in US manufacturing. The visual above, comparing US attributes to other advanced economies, situates US logistics infrastructure as a "strength but deteriorating."

7.04.2015

On June 30 (parts of) London joined (parts of) Atlanta, Austin, Baltimore, Dallas, Miami and New York as offering Amazon's one-hour delivery service.

About 10,000 products for specific delivery zones are served out of Amazon's existing East London Fulfillment Center and network of outsourced delivery firms. Expansion of the one-hour service to most of London and other cities in Southeast England is likely when Amazon's new Dunstable FC opens late this summer.

According to MarketWatch, Amazon, "is developing a mobile application that would pay ordinary people, rather than carriers such as United Parcel Service Inc. to drop off packages en route to other destinations." (Uberization of delivery?)

7.03.2015

Growth in US demand is not being matched by growth in supply capacity. In some regions just maintaining current capacity is a challenge.

A persistent shortage of truck drivers has suppressed supply capacity since at least 2012. The national deficit is now estimated at between 35,000 and 40,000 drivers. This is expected to worsen as a generational shift accelerates.

There are plenty of other challenges according to a new study by the Grocery Manufacturers Association and Boston Consulting Group:

Today, the problems are systemic and structural. Increasingly, leaders must make uncomfortable trade-offs: pay more to fulfill service level expectations or seek cost efficiencies, often at the expense of speed and reliability. Transportation costs are eroding supply chain cost savings. Since the last BCG/GMA study in 2012, freight costs have risen by as much as 14 percent, reversing the effects of all supply chain cost-saving efforts... Aging infrastructure and its corollary, growing congestion, are also to blame. America’s deteriorating roads, bridges, and railways receive C or D ratings from the American Society of Engineers. And according to the ASE, roughly half (or less) of what is needed to fix roads and bridges is spent each year, indicating little chance of improvement.

This is despite the decline in fuel costs. Nearly three-quarters of supply chain operators expect persistent increases in transportation-related costs (above).

7.02.2015

The US Department of Transportation has released a draft report on multi-modal transportation challenges between now and 2045. A few of its findings:

- America’s population will grow by 70 million by 2045.

- By 2050, emerging megaregions could absorb 75 percent of the U.S. population

- By 2045, freight volume will increase 45 percent.

- Online shopping is driving up demand for small package home delivery, which could soon substitute for many household shopping trips.

- Sixty-five percent of our roads are rated in less than good condition; a quarter of our bridges need significant repair

In the Portland Press Herald coverage of the DOT report is headlined: Gridlock is causing slow motion catastrophe.

7.01.2015

A global pandemic persisting over at least two years would result in wide-spread starvation in the United States. According to a study published in the Journal of Environmental Studies and Sciences, any event causing at least 25 percent labor absenteeism is likely to seriously disrupt the food supply chain.

Based on mathematical studies of the food production-to-distribution network, the authors conclude, "In the case of a pandemic, worker absenteeism may cause multiple points of failure within the food and agriculture system itself or in the interdependent systems that the food and agriculture system relies upon to function... This study found that the USA’s food system is not resilient against the expected level of worker absenteeism (20–40 %) during a pandemic."

Last year I facilitated a private-public exercise of a global pandemic's impact on the United States. That process anticipated many of the study's findings, especially in regard to labor shortage impact on trucking. The exercise also exposed a food system vulnerability not discussed in the paper. In one simulation, hoarding caused the food supply chain in a multi-state region to collapse almost two weeks before the first confirmed case of the disease.

Subscribe to:

Posts (Atom)