Compromised pipe in Shelby County Alabama has resulted in a substantial fuel spill and disruption of supply. The leak was first detected on September 9. Colonial Pipeline is providing

updates at this website. The pipeline transports refined products from refineries in Texas and Louisiana to markets throughout the southern, southeast, and mid-Atlantic states (see map above).

AL.com is doing a good job updating the repair process.

To stop the leak and repair the pipe, fuel transport has been discontinued in Colonial Pipeline 1. Some product adjustments are being made to a parallel pipeline to mitigate supply disruptions. On a typical day Colonial delivers about 2.6 million gallons of refined product. It is the principal source of refined products along its route between Houston and Baltimore. It is an important, but secondary source in markets between Baltimore and New York City.

On Saturday, September 17 the

Atlanta Journal Constitution reports, "Drivers in metro Atlanta and throughout the state faced long lines and dry pumps Saturday as fallout from an Alabama pipeline spill threatened gasoline supplies in Georgia." Substantial shortages are also being reported in the

Nashville region.

Loss or prospective loss of supply has prompted the Governors of Tennessee,

Alabama, Georgia, South Carolina, and

Virginia to declare state emergencies or take similar action. In Georgia an

executive order has suspended regulations limiting operator hours for commercial vehicles delivering transportation fuel. This is a common feature of actions being taken in the other states. (In many cases, major tanker companies will continue to comply with hour regulations even when waivers are provided to avoid the risk of negligence charges in case of accidents.)

Reuters reports some non-pipeline alternatives for fuel transport are springing up. But if the pipeline is repaired and transport begins early during the week of September 18, as expected, wide-spread shortages should be avoided north of Richmond, Virginia and may stay south of Charlotte [

September 19 update: some serious

shortages are emerging in the Charlotte metro area. Much earlier than I expected. Wish I had said Greensboro. But at this rate, even Richmond and north is not yet out of trouble]. Prices have already increased slightly in affected markets reflecting reduced supply.

September 20 Update: Today there will be widespread shortages in the Triangle market. Hoarding is definitely accelerating the problem. There are a few reports of stations going dry in Southern Virginia. Once one or two fail, hoarding will quickly bring down others.

Here's a

comment to make you stand up straight:

Petroleum Transport Terminal Manager Tommy Lowe says currently Greensboro's tank farm is virtually empty.

"We're looking at a week to 10 days before the product will actually get here. They've got to get it in, settled out, and then they'll turn it loose," said Lowe. "It's going to take a period of time when the product gets here to get the tank levels back up. We're looking at roughly two weeks to get things back to normal."

On Tuesday morning, September 20, Colonial announced:

Construction, fabrication and positioning of the bypass segment around the leak site is complete. Colonial is in the process of executing a hydrostatic test of the segment, which is approximately 500 feet in length, to ensure its structural integrity.

They hope to have flow restarted on Wednesday.

September 21 Update: According to Reuters federal approval has been given for the bypass line to be used to restart pipeline operations.

September 22 Update: Flow has resumed.

Nice wrap-up piece in AJC. Lots of opportunities here for lessons-learned. We often say that supply chains are socio-technical systems. In this case I perceive a close-call could have been mitigated by earlier technical measures targeting secondary-tertiary network effects and much more attention to the social dynamics behind hoarding.

RUNNING UPDATE: ABC News has aggregated an Associated Press

"ticker" on the pipeline disruption here. (not updated since September 19)

+++

When the Tennessee Governor's

executive order was released it was accompanied by the following verbiage:

Tennessee’s price gouging laws make it unlawful for individuals and businesses to charge unreasonable prices for essential goods and services including gasoline, food, ice, fuel, generators, lodging, storage space, and other necessities in direct response to a disaster regardless of whether that emergency occurred in Tennessee or elsewhere. The price gouging law makes it unlawful to charge a price that is grossly in excess of the price charged prior to the emergency. This price gouging act is triggered when a disaster is declared by the state or by the federal government. Penalties for violations of the price gouging act are up to $1,000 per violation. Additionally, the Tennessee Attorney General in conjunction with TDCI’s Division of Consumer Affairs can request that a court issue injunctions and order civil penalties of up to $1,000 for each violation. The state can also seek refunds for consumers.

What is the substantive difference between a meaningful market signal and price gouging?

According to

GasBuddy on Sunday morning, September 18 the average price of regular gasoline in metro Atlanta is $2.412 per gallon. Last Sunday the average price was $2.163. Over the same period the national average price has increased from $2.178 to $2.204... even as supplies totally drain away across Alabama and Georgia. No price gouging here.

Does the two-cent differential reflect reality? Certainly not in the short-term. Did it communicate to consumers their emerging risk? Does the two-cent differential incentivize significant changes in demand or supply behavior? Given current demand for gasoline tanker or maritime assets this is far less than needed to make it worthwhile to redirect current operations. Other than working to fix the break, the system is basically waiting for the return of the status quo ante. Hence absence of substantial retail supply in metro Atlanta... even with a week's warning.

Since product may be moving again in the next few days, maybe this is acceptable. In many other contexts I can imagine this passivity -- even denial of reality -- as serving to make a bad situation worse and worse.

+++

Some thinking-out-loud regarding

hoarding [September 20 morning]: Some claim that despite the loss of product -- more than half of typical flows in specific Southeast markets -- there is still enough supply to meet "typical" demand. But demand is quickly becoming atypical.

As individual gas stations (demand nodes) go dry, consumers see this as a threat-signal and adjust behavior. One widespread adjustment is frequent topping-off. While the consumer might typically wait until they have a quarter-tank of fuel, they begin to fill up whenever they approach three-quarters full.

This behavior has at least two dramatic impacts on the fuel supply chain: First, it produces entirely new patterns of pull signals. Most consumers typically fill up on a predictable schedule and even at a predictable place, this explosion of randomness undermines system stability. Second, this behavior increases overall demand at precisely the time that supply is fragile. The combination of increased demand and unpredictability of demand produces more dry pumps which, of course, further accelerates consumer hoarding.

In the particular case of Colonial Pipeline we may -- too early to be sure, but worth flagging -- be seeing a situation where a few market leading demand nodes (e.g. QuikTrip in Charlotte, Sheetz in other locations) are especially vulnerable because of their particular dependence on Colonial. As consumers see these market-leading sources go down, they shift to other secondary sources and begin to disrupt fuel supply chains that are not directly dependent on Colonial, but are now disrupted by unpredictable and unsustainable consumer behavior.

Thus over time and space, disruption of the fuel network begins to behave less like a fixable break in an engineered system and more like an ecology ingesting a contagion.

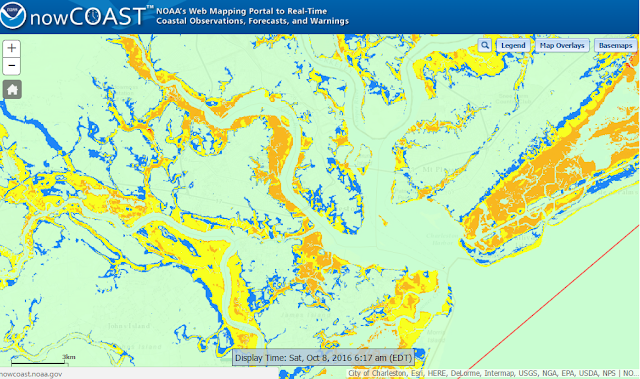

As I write this Hurricane Matthew has just begun to move up Florida's Atlantic coast. The map on the right shows projected wind speeds. Purple indicates 100 percent probability of wind speeds above 40 miles per hour. Gusts up to 107 MPH have been reported at several on-shore locations.

As I write this Hurricane Matthew has just begun to move up Florida's Atlantic coast. The map on the right shows projected wind speeds. Purple indicates 100 percent probability of wind speeds above 40 miles per hour. Gusts up to 107 MPH have been reported at several on-shore locations.