It's not bricks or bytes, its both.

Amazon challenges traditional retailers by increasing choice, reducing hassles, and locking-in loyalty. In many urban areas Amazon can also deliver purchases within one hour.

But delivering these advantages is expensive. In an October 27 conference call with financial analysts Amazon's CFO explained,

...in Q3 we added 18 fulfillment centers and we've added five more in October. For the year we'll add 26. Most of those are in North America but that compares to 14 last year and I would look, looking back the last time we had double-digit increase in fulfillment centers was in 2012 when we added 11 in the third quarter.... The number of warehouses that we added represents a 30% increase in square footage year-over-year. Last year we increased square footage by just under 20%. The definition of square footage in this case is all of our warehouses plus our sortation and delivery centers. So it's pretty much our customer service centers. So it's pretty much our full square footage that supports operation.

So those will dissipate as as they burn in. We've talked about fulfillment centers' initial startup costs include increase in fixed costs but also variable cost as we train workers and also bring in inventory. And there's a number of transportation costs also related to the startup of a new fulfillment center, both inbound and outbound. And they're inherently less efficient than more established mature buildings, so there will be a cycle where those will be more productive next year than they are this year and more productive in 2018 than they are in 2017.

So those will dissipate as as they burn in. We've talked about fulfillment centers' initial startup costs include increase in fixed costs but also variable cost as we train workers and also bring in inventory. And there's a number of transportation costs also related to the startup of a new fulfillment center, both inbound and outbound. And they're inherently less efficient than more established mature buildings, so there will be a cycle where those will be more productive next year than they are this year and more productive in 2018 than they are in 2017.Costs to build this future efficiency contributed to a decline in the third quarter's profit margin and last week investors responded by punishing the Amazon stock price by about six percent. (Seems short-sighted to me.)

Another big third quarter cost was shipping. According to Geekwire:

Amazon’s net shipping costs soared to nearly $1.75 billion in the third quarter, the second-highest quarterly total in the company’s history and the highest ever outside of the peak holiday season... Amazon’s rising shipping costs are driven by factors including the growth of the Amazon Prime membership program, with its core benefit of free two-day shipping; the expansion of the Fulfillment By Amazon (FBA) program, requiring more warehouse capacity; and Amazon’s push for rapid delivery across its business with AmazonFresh, Prime Now, and new same- and next-day shipping options.

Meanwhile, traditional retailers are focusing more and more on omnichannel marketing and sales -- competing online directly with Amazon -- while providing discounts if the customer picks-up the product at a brick-and-mortar location. According to the Wall Street Journal:

Wal-Mart is making more products available for same-day store pickup, staffing the pickup counter with more workers and stocking inventory closer to those workers to shorten wait times, a key consumer gripe. Pickup orders surged last holiday season and the retailer expects an increase this year...

“The large store-based retailers realized that if they want to compete with online retailers they need to leverage the strategic asset of the store,” said Steve Barr, retail consultant at PwC...

About 21% of Americans say they use in-store pickup regularly and 48% say they use it “on occasion,” according to a PwC survey of more than 2,100 people from earlier this year.

Getting more shoppers to pick up orders would be a welcome shift because retailers earn less when shipping directly to a customer’s home. Many shoppers also keep buying once in the store to retrieve an online order.The pick-up option -- if adroitly played -- gives retailers with an existing network of well-placed stores a significant advantage both in terms of e-commerce cost containment and the potential for up-selling. These existing networks are mostly suburban and exurban. Where car-culture continues to dominate, pick-up will often be preferred.

Today Amazon's PrimeNow is perhaps most widely used in Manhattan, Brooklyn, Seattle, Dallas, San Francisco, Los Angeles, Chicago, San Diego, Austin, Atlanta, Houston, Miami, Baltimore, Minneapolis, Tampa, Orlando, Northern Virginia and Portland, OR. The less likely the customer drives, the more likely direct customer delivery will remain the preferred option. Density decides.

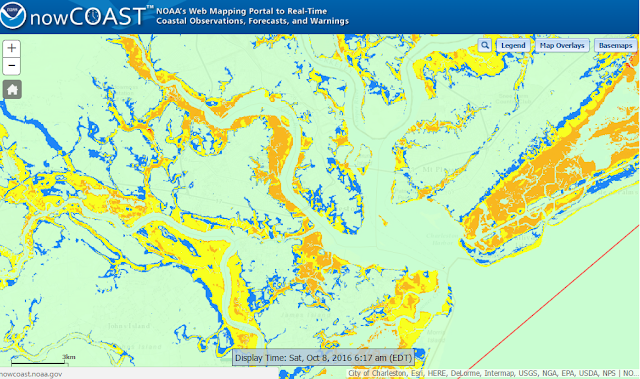

As I write this Hurricane Matthew has just begun to move up Florida's Atlantic coast. The map on the right shows projected wind speeds. Purple indicates 100 percent probability of wind speeds above 40 miles per hour. Gusts up to 107 MPH have been reported at several on-shore locations.

As I write this Hurricane Matthew has just begun to move up Florida's Atlantic coast. The map on the right shows projected wind speeds. Purple indicates 100 percent probability of wind speeds above 40 miles per hour. Gusts up to 107 MPH have been reported at several on-shore locations.