12.29.2015

Federal Express employees played Santa Claus, continuing to deliver on Christmas Day. A combination of bad weather in the Memphis area and a late surge of online orders spawned delivery delays.

No news was good news for UPS. Unseasonably warm weather in the densely populated northeast helped the package delivery giant make its holiday benchmarks, despite significantly increased demand. According to Zacks, "United Parcel preponed its order taking date by a day to Dec 21. The new policy also helped the express carrier to achieve on-time delivery rate between 97% and 98% this festive week. However, the company failed to match up to its regular delivery rate of 98% to 99%.

MasterCard reported, "U.S. e-commerce sales rose roughly 20% year over year between Black Friday and Christmas Eve. That compares with 7.9% for all U.S. retail sales, excluding automobiles." Of this increase, the New York Times reports that just over half was spent with Amazon, which "steamrolled through 2015, capturing an ever-growing share of United States retail sales. Of every additional $1 Americans spent for items online this year, Amazon captured 51 cents, according to a recent estimate by analysts at Macquarie Research."

12.25.2015

In his finalChristmas sermon, Dr. Martin Luther King, Jr., focused on the practical necessity of peace. At the core of his argument was the following description:

We are all caught in an inescapable network of mutuality, tied into a single garment of destiny. Whatever affects one directly, affects all indirectly. We are made to live together because of the interrelated structure of reality. Did you ever stop to think that you can't leave for your job in the morning without being dependent on most of the world? You get up in the morning and go to the bathroom and reach over for the sponge, and that's handed to you by a Pacific islander. You reach for a bar of soap, and that's given to you at the hands of a Frenchman. And then you go into the kitchen to drink your coffee for the morning, and that's poured into your cup by a South American. And maybe you want tea: that's poured into your cup by a Chinese. Or maybe you're desirous of having cocoa for breakfast, and that's poured into your cup by a West African. And then you reach over for your toast, and that's given to you at the hands of an English-speaking farmer, not to mention the baker. And before you finish eating breakfast in the morning, you've depended on more than half of the world. This is the way our universe is structured, this is its interrelated quality. We aren't going to have peace on earth until we recognize this basic fact of the interrelated structure of all reality.

We are all caught in an inescapable network of mutuality, tied into a single garment of destiny. Whatever affects one directly, affects all indirectly. We are made to live together because of the interrelated structure of reality. Did you ever stop to think that you can't leave for your job in the morning without being dependent on most of the world? You get up in the morning and go to the bathroom and reach over for the sponge, and that's handed to you by a Pacific islander. You reach for a bar of soap, and that's given to you at the hands of a Frenchman. And then you go into the kitchen to drink your coffee for the morning, and that's poured into your cup by a South American. And maybe you want tea: that's poured into your cup by a Chinese. Or maybe you're desirous of having cocoa for breakfast, and that's poured into your cup by a West African. And then you reach over for your toast, and that's given to you at the hands of an English-speaking farmer, not to mention the baker. And before you finish eating breakfast in the morning, you've depended on more than half of the world. This is the way our universe is structured, this is its interrelated quality. We aren't going to have peace on earth until we recognize this basic fact of the interrelated structure of all reality.

Especially at Christmas, commercial aspects of the supply chain overwhelm just about every other concern. But such commerce is often motivated by profound needs and great aspirations. Today Fedex employees are out delivering last minute purchases. What meaning may they also be delivering? And as Dr. King suggests, even the most quotidian outcomes of our work can have deeper implications.

12.23.2015

Amazon's pioneering work in online retail has helped transform US retail. Along the way, the company has depended upon -- and benefited -- United Parcel Service. But there is growing concern at the online retailer that the current UPS logistics network is unable to adapt to the demand-pull revolution sweeping retail.

According to the Wall Street Journal: "At Amazon, plans to handle more of its own parcels have accelerated over the past two years, according to current and former executives. Amazon also fears that UPS’s hub-and-spoke system—moving a package from shipper to sorting hub to brown van to your home—is growing obsolete, according to the executives. So the retailer is building regional distribution and package sorting centers, while adding thousands of truck trailers. It is even trying delivery by newspaper carriers."

According to the Wall Street Journal: "At Amazon, plans to handle more of its own parcels have accelerated over the past two years, according to current and former executives. Amazon also fears that UPS’s hub-and-spoke system—moving a package from shipper to sorting hub to brown van to your home—is growing obsolete, according to the executives. So the retailer is building regional distribution and package sorting centers, while adding thousands of truck trailers. It is even trying delivery by newspaper carriers."

Technological advancements allowing greater supply chain visibility and rapid adaptability to demand may be undermining the long-time comparative advantage of the hub-and-spoke strategy, allowing for a greater fluidity among and between more and smaller nodes.

12.22.2015

Tuesday, December 22 is expected to be the peak shipping day for UPS, FedEx, and many other shippers. Volume is expected to exceed any prior year.

According to the Wall Street Journal: "United Parcel Service Inc., FedEx Corp., and the U.S. Postal Service expected to ship more than 1.5 billion packages combined this year, an increase of more than 10% over last year. But volumes are already higher than forecast, resulting in delivery delays earlier this month as their networks were strained."

According to Motely Fool, "Retailers like Barnes & Noble, Gap, and J. Crew have set a Dec. 21 order deadline, perhaps challenging the ability of the carriers to come through. Yet they're not the ones pushing the envelope furthest. lululemon athletica, Macy's, and Sears have all promised delivery if orders are made by the 22nd, and Nordstrom even went so far as to set a Dec. 23 deadline. Interestingly, Best Buy, which two years ago had set a Dec. 23 drop-dead date and saw many missed deliveries, set a Dec. 17 deadline this year. While UPS and FedEx will again bear the brunt of the blame if packages aren't delivered on time, it's clear that it's really the retailers who are at fault if all you get in your Christmas stocking this year is a lump of coal."

According to the Wall Street Journal: "United Parcel Service Inc., FedEx Corp., and the U.S. Postal Service expected to ship more than 1.5 billion packages combined this year, an increase of more than 10% over last year. But volumes are already higher than forecast, resulting in delivery delays earlier this month as their networks were strained."

It has been difficult to accurately predict -- or adapt to -- the dramatic shift in online purchasing, especially as retailers promise to fulfill delayed purchases.

According to Motely Fool, "Retailers like Barnes & Noble, Gap, and J. Crew have set a Dec. 21 order deadline, perhaps challenging the ability of the carriers to come through. Yet they're not the ones pushing the envelope furthest. lululemon athletica, Macy's, and Sears have all promised delivery if orders are made by the 22nd, and Nordstrom even went so far as to set a Dec. 23 deadline. Interestingly, Best Buy, which two years ago had set a Dec. 23 drop-dead date and saw many missed deliveries, set a Dec. 17 deadline this year. While UPS and FedEx will again bear the brunt of the blame if packages aren't delivered on time, it's clear that it's really the retailers who are at fault if all you get in your Christmas stocking this year is a lump of coal."

12.21.2015

Yossi Sheffi's recent book on supply chain resilience is having more and more impact. A recent interview with DC Velocity provides a good, quick overview.

The final question/answer in the interview is, I perceive, especially important to a sustainable strategy of supply chain resilience:

Q: One of the arguments you make in the book is that by looking at your risk, by preparing for risk, you actually strengthen the entire enterprise. Expand on that a bit.

A: For an example, there is Intel. It had to map its entire supply chain. Knowing who the people upstream are, you not only get risk protection—the sense that if something happened to one of them, you know what the implications are—but you also learn more about what's going on in the supply chain. You start understanding your own supply chain a lot better, which always brings good things.

The final question/answer in the interview is, I perceive, especially important to a sustainable strategy of supply chain resilience:

Q: One of the arguments you make in the book is that by looking at your risk, by preparing for risk, you actually strengthen the entire enterprise. Expand on that a bit.

A: For an example, there is Intel. It had to map its entire supply chain. Knowing who the people upstream are, you not only get risk protection—the sense that if something happened to one of them, you know what the implications are—but you also learn more about what's going on in the supply chain. You start understanding your own supply chain a lot better, which always brings good things.

Mapping supply chains is non-trivial. Complete transparency is a complex undertaking, further complicated by proprietary implications and the advantage of rapid adaptation. But being explicit about nodes, links, and interdependencies is a fundamental aspect of risk management.

A recent report by Lloyds found, "Mapping supply chains can also help insurers review

their entire portfolio, both to look for areas of risk

accumulation – where they may want to run scenarios

– and to identify areas of opportunity, where little

insurance is currently written and there is limited

connection with insured risks."

What is helpful for the insurer is even more helpful for the insured.

12.16.2015

12.11.2015

Chart by Statista as of September 2015

According to the Wall Street Journal, a huge increase in online orders is threatening to, again, overwhelm shipping firms between now and Christmas. According to data analysis, last week the on-time delivery rate for UPS fell from 97 percent last year to 91 percent this year. Given the lack of large weather disruptions, this suggests difficulty managing volume... already.

For the five days -- Thanksgiving through Cyber-Monday -- several data sources suggest a roughly 20 percent increase in online purchases compared to 2014 and about a ten percent decline for in-store purchases year-to-year.

There are also other market signals suggesting surging online consumer demand and tight supply. According to DCVelocity,

From Nov. 29 to Dec. 5, spot rates for dry vans, the most commonly used form of truck equipment, jumped 6 cents, to $1.77 per mile, DAT said in data made available late yesterday. The load-to-truck ratio, which measures the number of dry van loads per available truck, jumped 32 percent, to 2.8 loads per truck, from 2.1 in the prior week. Last week, van loads posted for booking on DAT's load boards rose 49 percent, about doubling the normal levels for this time of year, which included the first full workweek after the holiday. Truck posts during the December week rose only 11 percent, setting up the surge in prices, according to DAT.

Earlier this year a 3PL executive told me he expected more and more disruption as demand will increasingly exceed the current availability of logistics to deliver.

12.10.2015

Allianz has released a new analysis: "Global Claims Review 2015: Business Interruption In Focus". According to the insurance firm:

The greater interconnectivity of the global economy is manifesting itself in increasingly more complex production processes with higher economic values. The end result is more severe business interruption (BI) implications. For insurers this means potentially larger and more complicated losses than in the past. It also means that one event – like a fire at a factory or a flood in one region – can generate many claims from large numbers of companies.

As a result the insurance industry is increasingly requiring the insured party to examine risk across its supply chain and attempt to mitigate any significant vulnerability of business interruption.

The greater interconnectivity of the global economy is manifesting itself in increasingly more complex production processes with higher economic values. The end result is more severe business interruption (BI) implications. For insurers this means potentially larger and more complicated losses than in the past. It also means that one event – like a fire at a factory or a flood in one region – can generate many claims from large numbers of companies.

As a result the insurance industry is increasingly requiring the insured party to examine risk across its supply chain and attempt to mitigate any significant vulnerability of business interruption.

12.03.2015

Above from DynamicAction Holiday Retail Index

The increasing role of online sales -- and delivery and returns -- is squeezing already thin retail profit margins. According to a study by IHC, commissioned by a supply chain tech company,

... retailers continue to underestimate the impact of holiday demand on warehouse operations. While most retailers have a goal to ship within a day, the data suggests that orders will climb to roughly 1.6 days to ship during mid-December. Despite the expectation to receive orders in time for the holidays, consumers are extremely price-conscious when it comes to shipping. Willingness to pay for express shipping is down, as evidenced by express shipping decreasing 25% compared to this time last year.

AND

Data revealed that returns are already up 9.3% over 2014 heading into the holidays. Even worse, the amount of profit being returned has jumped 19%, suggesting that customers are returning the more profitable items at a higher rate.

Combine these online trends with the ubiquitous expectation for price promotions (chart above) and finding a net revenue stream is getting more and more difficult.

Online retail is increasingly a struggle between those able to best sustain significant losses in an effort to be the last one standing... or the innovator that finds a sustainable strategic advantage. Supply chain operations is probably one of the prime possibilities for finding/crafting a fundamental transformational

12.01.2015

The Business Continuity Institute and Zurich Insurance have released their analysis of a 2015 survey of supply chain decisionmakers. Go here for the complete report.

11.30.2015

According to the National Retail Federation:

More than 151 million people said they shopped either in stores and/or online over the weekend, according to NRF's survey conducted by Prosper Insights & Analytics. Nearly 102 million people say they shopped in stores over the Thanksgiving weekend, and more than 103 million say they shopped online. Those under 35 were most likely to shop over the weekend.

More than 151 million people said they shopped either in stores and/or online over the weekend, according to NRF's survey conducted by Prosper Insights & Analytics. Nearly 102 million people say they shopped in stores over the Thanksgiving weekend, and more than 103 million say they shopped online. Those under 35 were most likely to shop over the weekend.

CNET reported that so-called Cyber Monday "reached $3 billion in sales, up 12 percent from last year... making it the largest online sales day in the US ever."

The increasing strength of online retail is straining -- and driving innovation, competition, and occasional desperation -- across supply networks.

11.27.2015

According to the constantly updating IBM Benchmark Survey:

Thanksgiving Day online sales were up 26 percent compared to a year ago. But the average spend per order on Thursday was $123.45, down from $125.25 a year ago. In 2013 the average total purchase on Thanksgiving Day was $132. Roughly a third of purchases are being made on mobile devices.

As of mid-day on Black Friday tracking suggested a possible decline in year-to-year online sales.

11.25.2015

According to CBRE:

Over the past 35 years, global trade has increased by nearly 600%, propelling the growth of logistics hubs in virtually every country around the world.

These hubs are connected via hub-and-spoke systems centered around 30 global logistics hubs—including the likes of Los Angeles, Chicago, Hong Kong, Tokyo, London and Paris—that form the backbone of today’s global supply chain.

However, as emerging markets grow and new centers of production materialize, 20 emerging markets are on the verge of becoming global logistics hubs over the next decade, including South Florida, Bajio, Busan, Suzhou, Berlin and Amsterdam.

These locations warrant close attention from the marketplace, as logistics hubs are typically home to large clusters of distribution facilities that are highly sought after by major real estate investors and logistics operators.

11.21.2015

11.19.2015

According to the Los Angeles Times:

The neighborhoods of West Los Angeles may have gotten it first, but Google's overnight delivery service, Google Express, is now available to everyone in Southern California, from San Diego to Anaheim to Downtown L.A.

With the expansion of the service, customers across Southern California will have the option to sign up for a $95 annual membership, or pay a fee of $4.99 per eligible order to use the service.

Once registered, customers can browse products from different retailers through the Google Express portal and have those products delivered overnight. Residents in West Los Angeles can have certain items delivered the same day.

The neighborhoods of West Los Angeles may have gotten it first, but Google's overnight delivery service, Google Express, is now available to everyone in Southern California, from San Diego to Anaheim to Downtown L.A.

With the expansion of the service, customers across Southern California will have the option to sign up for a $95 annual membership, or pay a fee of $4.99 per eligible order to use the service.

Once registered, customers can browse products from different retailers through the Google Express portal and have those products delivered overnight. Residents in West Los Angeles can have certain items delivered the same day.

11.17.2015

Borders, natural or legal or otherwise, complicate supply networks. Reducing time-or-space division is one way of describing the goal of supply chain management. The sudden emergence of unexpected divisions can be especially disruptive. But in an open system supply networks will tend to be quickly creative in finding a way around. According to Marketplace, in response to the Paris attacks and the threat of more several European nations are considering long-term reestablishment of border controls that would significantly impact the supply chain.

11.16.2015

Recently I received a copy of a study conducted by UPS on the healthcare supply chain. A global survey asked, among many other things, about the respondents perceptions of contingency planning. UPS found the answers disconcerting. Below is an excerpt from their report.

11.10.2015

Last week's passage of a House Transportation bill is important to long-term supply chain efficiency and resilience. According to Politico:

The House's base bill, which passed in a 363-64 vote, authorizes nearly $340 billion for highway and transit program over six years. The original bill would have paid for just three years of funding, but an amendment adopted at the last minute Thursday could add an additional $40 billion, shoring up funding for the life of the bill.

But according to The Trucker, the political "break-through" may be almost too little, too late in terms of what is really needed.

Marcia Hale, president of Building America’s Future, an organization that promotes infrastructure investment, laid it on the line, reflecting many complaints about the need to address the nation’s highway, bridge and transportation network’s condition.

“Congress has a history of kicking the can down the road with short-term funding bills that make it highly difficult for projects — such as road and bridge maintenance, and transit network repairs — to start or continue,” Hale said. “While we see this long-term bill as a positive sign, we still believe that the funding levels outlined (in the bill) are less than optimal, and will hardly make a dent in the massive infrastructure and transportation funding deficit currently facing our country.”

The House's base bill, which passed in a 363-64 vote, authorizes nearly $340 billion for highway and transit program over six years. The original bill would have paid for just three years of funding, but an amendment adopted at the last minute Thursday could add an additional $40 billion, shoring up funding for the life of the bill.

But according to The Trucker, the political "break-through" may be almost too little, too late in terms of what is really needed.

Marcia Hale, president of Building America’s Future, an organization that promotes infrastructure investment, laid it on the line, reflecting many complaints about the need to address the nation’s highway, bridge and transportation network’s condition.

“Congress has a history of kicking the can down the road with short-term funding bills that make it highly difficult for projects — such as road and bridge maintenance, and transit network repairs — to start or continue,” Hale said. “While we see this long-term bill as a positive sign, we still believe that the funding levels outlined (in the bill) are less than optimal, and will hardly make a dent in the massive infrastructure and transportation funding deficit currently facing our country.”

Big changes in consumer purchasing behavior, increasing population concentration, and the new opportunities presented by the expansion of the Panama Canal -- to mention but a few -- converge to present significant transportation challenges for the next thirty-plus years.

11.07.2015

A West Coast colleague pointed me to a fantastic collection of maps for the retail grocery industry at Big Think. Each one is interesting -- though not entirely accurate according to my understanding. Taken together the collection helps suggest the sort of retail ecology on which the US population depends. Below is the distribution of Target stores.

11.04.2015

The Centers for Disease Control and Prevention has confirmed that what seems like a lot of foodborne disease outbreaks really is happening. The number has nearly tripled over the last twenty years. Concentration of production, processing, and distribution serves to amplify the impact of many outbreaks.

10.29.2015

From a much longer UPS news release on this year's Peak Season:

UPS expects to deliver more than 630 million packages between Black Friday and New Year’s Eve, an increase of more than 10 percent over holiday deliveries last year. This UPS peak holiday shipping period includes an additional shipping day before Christmas versus 2014.

The company plans to deliver about 36 million packages on Tuesday, Dec. 22, up from 35 million last year, and double the normal daily average of 18 million deliveries. Consumers’ preference for ecommerce, coupled with the industry’s most often selected delivery solutions have driven UPS’s peak volume to all-time highs. The company tallied about 17 million deliveries on its peak delivery day just 10 years ago.

Since Christmas falls on Friday this year UPS plans for high daily residential delivery volume throughout the week. The company expects to make a record number of deliveries to residential addresses during the holiday period, up to 60 percent of all package deliveries, versus an average of 45 percent on a full-year basis

In 2010 Forester predicted US online retail would exceed $250 billion by 2014. Actual numbers came in at just over $304 billion. In mid-2014 Forrester offered the projections shown above.

10.27.2015

Last-mile can often be "golden". For many products long-haul is a commodity business. In today's (and probably tomorrow's) tight market for trucking, fleet management is fundamental. But there is not much need or pay-off for mass customization. A case can even be made that such a strategy is non-scalable (so far).

But within twenty-or-so miles of a supply node, customization is almost constant. As more products are increasingly delivered direct to consumers, the needs and potential pay-offs of effective -- systematic -- customization will grow.

UPS and Fedex have clearly benefited from this trend. USPS as well. Uber is targeting the potential. Last week Baird Equity Research suggested that Amazon is beginning to probe (then adapt, then accelerate) operations as a direct-delivery provider.

According to Baird's analysis:

Our assessment of Amazon's broadening fulfillment ecosystem, internal domain expertise, and early initiatives with Prime Now to offer third-party delivery suggests there is evidence Amazon may ultimately pursue more comprehensive third-party services. Similar to the gradual rollout of AWS, we would expect Amazon to introduce competitive transportation and logistics services on an incremental basis, with a long-term focus. Ideal customers for ATL (Amazon Transportation & Logistics) would range from SMBs to enterprise businesses that lack financial resources, expertise, or technology horsepower to manage fulfillment/logistics internally, and with an offering that raises the competitive bar vs. incumbent service providers. Amazon currently operates >165 fulfillment centers worldwide, and is already testing “last mile”delivery of products not sold via Amazon’s websites.

But within twenty-or-so miles of a supply node, customization is almost constant. As more products are increasingly delivered direct to consumers, the needs and potential pay-offs of effective -- systematic -- customization will grow.

UPS and Fedex have clearly benefited from this trend. USPS as well. Uber is targeting the potential. Last week Baird Equity Research suggested that Amazon is beginning to probe (then adapt, then accelerate) operations as a direct-delivery provider.

According to Baird's analysis:

Our assessment of Amazon's broadening fulfillment ecosystem, internal domain expertise, and early initiatives with Prime Now to offer third-party delivery suggests there is evidence Amazon may ultimately pursue more comprehensive third-party services. Similar to the gradual rollout of AWS, we would expect Amazon to introduce competitive transportation and logistics services on an incremental basis, with a long-term focus. Ideal customers for ATL (Amazon Transportation & Logistics) would range from SMBs to enterprise businesses that lack financial resources, expertise, or technology horsepower to manage fulfillment/logistics internally, and with an offering that raises the competitive bar vs. incumbent service providers. Amazon currently operates >165 fulfillment centers worldwide, and is already testing “last mile”delivery of products not sold via Amazon’s websites.

10.23.2015

Amazon's stock soared to a new high today on news of modest profits on strong earnings that far outpaced expectations. Amazon's sales rose 30% over the same period in 2014.

Which was a bit like a poke in the eye for Walmart which one week ago projected profits falling by as much as twelve percent next year as it invests in ecommerce -- especially supply chain enhancement -- and improved customer service.

Thursday the New York Times published a nice comparison/contrast of Walmart and Amazon. Nothing not already reported by this blog, but a helpful overview. The shift to online retail is occurring even faster than many predicted. Amazon's supply chain is optimized for online purchasing and home delivery. Walmart's supply chain dominated the supercenter age. Sears commanded telegraph and railways.

10.21.2015

According to the Wall Street Journal:

The biggest landlords in the U.S. are being crushed under a mountain of packages, leading one large apartment operator to stop accepting deliveries and others to experiment with ways to minimize the clutter.

The moves are at the center of two colliding trends: an increase in apartment living and a surge in online shopping. The result is a rising tide of packages with no good place to go.

U.S. online retail sales are expected to swell to $334 billion in 2015, up from $263 billion in 2013, according to Forrester Research Inc., a research and advisory firm. Analysts at Forrester expect that number to increase to $480 billion in 2019.

Just wait until Christmas.

10.19.2015

According to the MIT Sloan Management Review:

...access to transparent, accurate data is a prerequisite for effective supply chain collaboration and coordination. Lack of transparency is often born from a lack of trust or confidentiality issues. But we are already seeing progressive companies developing novel solutions to this dilemma — such as data “cleanrooms” and digital marketplaces.

What we call data “cleanrooms,” often managed by a third party, allow the sharing of sensitive data (for example, consumer demand, product cost breakdown, and asset utilization) in a legal and secure data environment that lets participants better identify and size opportunities for joint value creation.

For a few years now many of us have been talking about how there needs to be a kind of Federal Reserve System for supply chains. It is sometimes forgotten that the Fed is a sophisticated private-public partnerships. And especially at the regional level, the private sector is arguably predominant.

What the Fed has done to clarify and manage -- and crucially troubleshoot -- the money supply, another private-public partnership could do for other supplies.

...access to transparent, accurate data is a prerequisite for effective supply chain collaboration and coordination. Lack of transparency is often born from a lack of trust or confidentiality issues. But we are already seeing progressive companies developing novel solutions to this dilemma — such as data “cleanrooms” and digital marketplaces.

What we call data “cleanrooms,” often managed by a third party, allow the sharing of sensitive data (for example, consumer demand, product cost breakdown, and asset utilization) in a legal and secure data environment that lets participants better identify and size opportunities for joint value creation.

For a few years now many of us have been talking about how there needs to be a kind of Federal Reserve System for supply chains. It is sometimes forgotten that the Fed is a sophisticated private-public partnerships. And especially at the regional level, the private sector is arguably predominant.

What the Fed has done to clarify and manage -- and crucially troubleshoot -- the money supply, another private-public partnership could do for other supplies.

10.15.2015

Walmart practically destroyed Sears and transformed the grocery industry by deploying late 20th Century supply chain strategies. It is now competing for the 21st Century strategic high-ground.

On October 14 the Dow Jones Industrials fell over 150 points (and Albertson's held back from its IPO) as Walmart's stock price fell 10 percent and led the retail sector in reporting disappointing results and prospects. The world's largest retailer has loss 30 percent market value since January.

According to the Wall Street Journal:

For months Wal-Mart executives have subtly made their case that investors should view the company as a growing e-commerce player that happens to be a behemoth. It has asked them to be patient as the retailer, which has half a trillion in annual sales, spends heavily to turn the giant ship around to better compete with Amazon.com Inc. and other faster-growing retailers like Kroger Co. and Costco Wholesale Corp.

Wal-Mart’s “biggest competitor is online and doesn’t care about profits. It’s hard,” said Mr. Yarbrough, referring to Amazon...

Wal-Mart is pitching its stores and massive network of distribution centers as a key strength in its battle with Amazon. In a PowerPoint presentation Wednesday, Mr. McMillon, the CEO, showed investors a slide with pictures of online retailers that have opened brick-and-mortar locations, including Warby Parker and Rent the Runway.

“Here is a key question: Will it be easier for an e-commerce company to build out a massive store network and create a customer-service culture at scale, or are we better able to add digital and supply-chain capabilities and leverage our existing stores?,” he said.

Personal story: Tuesday Amazon did not get me a promised one-day delivery (I am not a Prime member and had paid $60 for the fast service). I complained. Within six minutes I had a seemingly (not really) personalized response and a full refund. I've since received my product. That's a capability that will be very tough to equal. Stand by for a furious fight.

On October 14 the Dow Jones Industrials fell over 150 points (and Albertson's held back from its IPO) as Walmart's stock price fell 10 percent and led the retail sector in reporting disappointing results and prospects. The world's largest retailer has loss 30 percent market value since January.

According to the Wall Street Journal:

For months Wal-Mart executives have subtly made their case that investors should view the company as a growing e-commerce player that happens to be a behemoth. It has asked them to be patient as the retailer, which has half a trillion in annual sales, spends heavily to turn the giant ship around to better compete with Amazon.com Inc. and other faster-growing retailers like Kroger Co. and Costco Wholesale Corp.

Wal-Mart’s “biggest competitor is online and doesn’t care about profits. It’s hard,” said Mr. Yarbrough, referring to Amazon...

Wal-Mart is pitching its stores and massive network of distribution centers as a key strength in its battle with Amazon. In a PowerPoint presentation Wednesday, Mr. McMillon, the CEO, showed investors a slide with pictures of online retailers that have opened brick-and-mortar locations, including Warby Parker and Rent the Runway.

“Here is a key question: Will it be easier for an e-commerce company to build out a massive store network and create a customer-service culture at scale, or are we better able to add digital and supply-chain capabilities and leverage our existing stores?,” he said.

Personal story: Tuesday Amazon did not get me a promised one-day delivery (I am not a Prime member and had paid $60 for the fast service). I complained. Within six minutes I had a seemingly (not really) personalized response and a full refund. I've since received my product. That's a capability that will be very tough to equal. Stand by for a furious fight.

10.12.2015

10.06.2015

On October 1 Walmart opened a new fulfillment center. According to the company, "The 1.2 million sq. ft. facility in Union City, just south of Atlanta, is the third large-scale e-commerce fulfillment center to open in the U.S. in as many months, and features state-of-the-art automation and warehousing systems."

According to Reuters:

Competition with online rivals including Amazon.com, which recently surpassed it in market value, has heated up and Wal-Mart has committed as much as $1.5 billion this year to invest in e-commerce. Much of that is going into large-scale warehouses dedicated to fulfilling online orders. It now has five such facilities, from which it says it will be able deliver to 95 percent of country in two days. The facilities - some big enough to house two cruise liners - will enable it to receive, sort and ship packages faster and at a lower cost, Michael Bender, chief operating officer of global e-commerce, said in an interview.

Last week Amazon opened a similar-sized new fulfillment center outside Baltimore. According to The Sun:

The 1 million-square-foot fulfillment center, which the state and city lured to Baltimore two years ago with an incentive package of more than $43 million, started operations March 30, while still under construction. Now tens of thousands of packages ship to customers each day from the building. The firm also opened a smaller sorting center nearby last October. The bigger building, where Amazon now employs more than 3,000 people, is open 24 hours a day, with staff working in staggered 10-hour, four-day-a-week shifts.

According to Reuters:

Competition with online rivals including Amazon.com, which recently surpassed it in market value, has heated up and Wal-Mart has committed as much as $1.5 billion this year to invest in e-commerce. Much of that is going into large-scale warehouses dedicated to fulfilling online orders. It now has five such facilities, from which it says it will be able deliver to 95 percent of country in two days. The facilities - some big enough to house two cruise liners - will enable it to receive, sort and ship packages faster and at a lower cost, Michael Bender, chief operating officer of global e-commerce, said in an interview.

Last week Amazon opened a similar-sized new fulfillment center outside Baltimore. According to The Sun:

The 1 million-square-foot fulfillment center, which the state and city lured to Baltimore two years ago with an incentive package of more than $43 million, started operations March 30, while still under construction. Now tens of thousands of packages ship to customers each day from the building. The firm also opened a smaller sorting center nearby last October. The bigger building, where Amazon now employs more than 3,000 people, is open 24 hours a day, with staff working in staggered 10-hour, four-day-a-week shifts.

Construction companies for distribution and fulfillment centers say that since the turn of the century the average size of new facilities has tripled to just about 900,000 square feet. As Amazon and Walmart demonstrate, plenty are even larger.

10.04.2015

The National Weather Service is forecasting a potentially very strong El Niño Effect for the upcoming Winter and early Spring: "All models surveyed predict El Niño to continue into the Northern Hemisphere spring 2016, and all multi-model averages predict a peak in late fall/early winter."

East Asia and Southern California may experience especially significant effects. Typhoon Etau's mid-September hit on Japan is seen by many forecasters as a precursor of the potential for extreme outcomes.

A White Paper by one supply chain software firm notes, "The recent flooding from Severe Tropical Storm Etau in Japan is the first significant

manifestation of El Niño. It may serve as a wakeup call for CPOs and organizations

complacent about the potential El Niño threat to supply chain operations. It is also

illustrative of the types of El Niño impacts that organizations can expect and the

opportunities for proactive threat mitigation actions moving forward."

Roughly sixty percent of US imports arrive at the Ports of Los Angeles and Long Beach.

10.01.2015

Amazon is recruiting 1099-contract drivers to deliver packages within one-hour in a Seattle test-drive. They call the test AmazonFlex. According to Wired:

Flex fits neatly into Amazon’s ultimate goal to own all retail. Over the years, Amazon has built up a massive logistics infrastructure to make convenient deliveries scalable. It’s poured money into building huge fulfillment centers near major metro areas, which has eaten hugely into the company’s bottom line. Now, owning a platform for on-demand workers on top of all that could help the company hammer out streamlined delivery routes using tracking software.

Motley Fool comments, "Amazon.com is constructing massive warehouses in the outskirts of America's biggest cities that could serve as a durable competitive advantage for generations to come."

According to Wired, Amazon aspires to be the dominant set-of-nodes in US (and beyond) retail. Meanwhile, retail competition caused by Amazon is producing a proliferation of nodes and innovation. Is the increased system resilience transient?

9.30.2015

The founder and CEO of Starbucks was a head-liner at this week's Council of Supply Chain Management Professionals (CSCMP) annual conference.

Reflecting on Starbucks' near-death and strong recovery, DCVelocity reports that Howard Schultz told the crowd, "Growth and success covers up mistakes," At Starbucks this included a supply chain that was mostly unknown. It was an ignorance for which they paid dearly. Only on the edge of failure did the company finally take its supply chain seriously. Schultz now credits supply chain management as the "primary co-author of our business. You cannot scale a company of any kind without the skills and base of a supply chain."

Schultz continued, "Given the fact that the Internet as we know it today is literally the death of distance, and that distance is getting narrower and narrower in terms of the last ten feet, …that is now being linked to delivery, specifically short-term delivery that could be in an hour or 30 minutes. With all these things going on, it won’t be status quo as we know it today."

In my own experience the biggest impediment to improving supply chain resilience is success. The greater the success, the less time, energy, or inclination remains for the self-critique and perspective that informs resilient choices.

9.29.2015

The 2015 annual survey of Third Party Logistics (3pl) is now available. The Wall Street Journal reports that the survey indicates, "A recent wave of logistics industry mergers and acquisitions is likely to accelerate in the coming year,..The survey found that many chief executive officers of third-party logistics operators, which arrange transportation and logistics services for retailers and manufacturers, expect to see defensive acquisitions growing in the wake of 10 major deals totaling $18 billion signed since early 2014."

9.27.2015

Last Thursday (09/24/2015) Coca-Cola announced, "the formation of a new National Product Supply System (“NPSS”) in the United States. The mission of the NPSS will be to facilitate optimal operation of the U.S. product supply system for Coca-Cola bottlers in order to:

- Achieve the lowest optimal manufactured and delivered cost for all bottlers in the Coca-Cola system

- Enable system investment to build sustainable capability and competitive advantage

- Prioritize quality, service and innovation in order to successfully meet and exceed customer and consumer requirements."

If the action and its purpose still strike you as obscure, don't feel alone. Bureacracies, public or private, tend to all sound alike. Maybe that's why the stock price barely budged.

Here's how Reuters interprets the announcement:

The world's largest soda maker is facing sluggish sales volumes in the U.S.. It has been selling bottling operations, which partly entail getting its products to retailers, to franchisees to shift away from the capital intensive and low-margin business of distribution.

Until now, though, it has not sold production facilities, where its concentrate is combined with other ingredients and bottled up. The sale of the plants, which produce soft drinks like Coke, Sprite and Fanta, is expected to take place between 2016 and 2018, Coca-Cola said.

"By selling production facilities, we expect (Coke) will generate higher return on invested capital as its capital base is reduced, and have incremental cash to reinvest and return to shareholders," said Bonnie Herzog, an analyst at Wells Fargo, in a note

The Wall Street Journal included the following in its report on the deal:

What I see is another move toward functional disaggregation and strategic concentration. Supply chains tended to be vertically integrated. Supply networks tend to be horizontally collaborative. Each participant in the network seeks to identify and amplify its particular comparative advantage and cooperate with the best-of-class in other areas of functional expertise.

9.25.2015

In August the City of Moreno Valley (CA.) approved development of the World Logistics Center for a site on the eastern edge of the Inland Empire jurisdiction. According to the city:

Generally, the project site is located east of Redlands Boulevard, south of the SR-60, west of Gilman Springs Road, and north of the San Jacinto Wildlife Area. The proposed World Logistics Center (WLC) project area is approximately 3,818 acres and includes a new 2,610 acre Specific Plan area. The project is envisioned to accommodate up to 40.6 million square feet of high cube industrial warehouse distribution development and related uses. (Map above)

In recent years one of the most significant economic engines for the region East of Los Angeles has been the proliferation of warehousing, product sorting, distribution and other supply chain functions. This new project is the largest yet,

There are several legal actions underway to challenge the project. But as far as I know, no one is questioning the seismic sustainability of the site or the resiliency of its construction. Below is another map showing the site's proximity to the San Andreas fault (the red line 18 miles east). It is even closer to the San Jacinto Fault.

It is amazing how much we are investing in -- and depending on -- areas that we can be sure will be hit hard, even while giving minimal attention to mitigation.

9.23.2015

MIT is hosting an October 15 Conference on transportation and the Internet-of-Things (IoT)

According to the widely-circulated invitation:

Our transportation system is not meeting the needs of our changing trade and diverse population. Capacity is shrinking just as our demand is growing. How will the Internet of Things address these increasing challenges? The transportation market has responded with new services and technologies, from IoT to telematics, and mobility to RFID and sensors for asset tracking. Trucks, ships, and trains are already loaded with technologies which continue to be enhanced to improve on time, safety, and cost metrics.

According to the widely-circulated invitation:

Our transportation system is not meeting the needs of our changing trade and diverse population. Capacity is shrinking just as our demand is growing. How will the Internet of Things address these increasing challenges? The transportation market has responded with new services and technologies, from IoT to telematics, and mobility to RFID and sensors for asset tracking. Trucks, ships, and trains are already loaded with technologies which continue to be enhanced to improve on time, safety, and cost metrics.

More information and an opportunity to register HERE.

9.20.2015

Home Depot has opened its third facility committed entirely to filling online orders. According to the Toledo Blade:

The first was placed in Georgia near corporate headquarters and the second in California to service the west coast. But the third facility is the largest yet, at 1.6 million square feet.

Northwest Ohio was a perfect fit for what Home Depot was looking for.

"Geographically, this gives us reach to all of our customers zip codes, about 90 percent of the U.S. population within two shipping days." said Scott Spata, Vice President of Home Depot Direct Fulfillment.

This facility is where online orders are sorted and shipped directly to the customers.

While Home Depot stores hold 35,000 items, Online direct services offer one million products to chose from.

The first was placed in Georgia near corporate headquarters and the second in California to service the west coast. But the third facility is the largest yet, at 1.6 million square feet.

Northwest Ohio was a perfect fit for what Home Depot was looking for.

"Geographically, this gives us reach to all of our customers zip codes, about 90 percent of the U.S. population within two shipping days." said Scott Spata, Vice President of Home Depot Direct Fulfillment.

This facility is where online orders are sorted and shipped directly to the customers.

While Home Depot stores hold 35,000 items, Online direct services offer one million products to chose from.

9.18.2015

According to the Wall Street Journal:

At its hub in Louisville, Ky., United Parcel Service Inc. recently rolled out 100 industrial-grade 3-D printers to make everything from iPhone gizmos to airplane parts.

UPS wants to find out if 3-D printing centers could shorten supply chains and cut into its $58 billion-a-year transportation business—or give it a leg up in a potentially emerging market for local production and delivery.

For Atlanta-based UPS, the difference could be existential. It doesn’t want 3-D printing to disrupt its business the way the Internet pulled the rug out from overnight document deliveries more than a decade ago. MORE.

At its hub in Louisville, Ky., United Parcel Service Inc. recently rolled out 100 industrial-grade 3-D printers to make everything from iPhone gizmos to airplane parts.

UPS wants to find out if 3-D printing centers could shorten supply chains and cut into its $58 billion-a-year transportation business—or give it a leg up in a potentially emerging market for local production and delivery.

For Atlanta-based UPS, the difference could be existential. It doesn’t want 3-D printing to disrupt its business the way the Internet pulled the rug out from overnight document deliveries more than a decade ago. MORE.

9.14.2015

Over the weekend I was talking to a leading transportation specialist who, while drinking at the time, soberly said, "Transportation policy in this nation does not currently exist. There are putative policy notions. There is no extant policy, sustainable funding, or credible vision for policy or funding."

According to The Hill:

Even as they maintain that they want to strike a major deal in the next few months, House Republicans still face a number of obstacles in reaching an agreement with a skeptical Senate before the end of 2015.

Lawmakers currently have an Oct. 29 deadline for extending highway programs, and had been under the impression that the Highway Trust Fund could easily be replenished through mid-December.

If the House is unable to make progress on both its international tax plan and highway policy in the coming months, the chamber could be forced to accept a Senate highway bill passed this summer that House leaders have repeatedly said is riddled with deficiencies. The Senate bill authorizes six years worth of highway policy, but only includes funding for three years.

Already, the House Transportation Committee has had to put off its plans to consider a six-year highway bill, and have not announced a timeline for when it will take up a measure — raising the chances that the House will be unable to pass its own long-term bill and then hash out a compromise with the Senate by the October deadline.

Last month Politico published a special edition on transportation (that I just noticed). See The Agenda: Transportation.

9.12.2015

This weekend I am trying to get through some accumulated reading, including an August White Paper entitled "Food Industry Logistics: Trends that Matter". A couple of quotes:

THEN: Logistics networks have been designed with mindsets relevant to a prior era. Production and distribution efficiencies commonly drive product and placement. The infrastructure and apparatus are built around a high proportion of (and preference for) heavily processed foods with extended shelf life. Large manufacturing plants and distribution centers are prevalent, and efficiencies have been built around bulk shipments, which have often driven product assortment decisions. Lastly, outbound distribution models have been designed by large players to maximize their bottom line relying on fairly predictable demand rather than to respond optimally to consumer on-the-go needs.

NOW: Growing consumer expectations for freshness require shorter farm-to-fork times and distances. There has been major growth in small-footprint urban retail locations, as well as substantial growth in home delivery from online channels (e.g., Blue Apron). “Uber-type” on-demand deliveries in a one- to four-hour timeframe have also come to market... There is growth in nontraditional retail and foodservice channels (e.g., limited-assortment and fresh-format stores, specialized chains). Convenience retailers are actively working to deliver a broader, fresher and better variety of prepared foods to customers. Emerging channels like food trucks and farmers markets with unique offerings are also developing; many are harnessing the power of social media to reach consumers.

IMPLICATIONS: This will radically impact food industry logistics.... The increasing need to be closer to customers necessitates additional brick-and-mortar facilities (e.g., distribution centers, cross docks). To speed up cycle time even further, robots, automation and advanced technologies will be required.

I agree this is happening. I agree it could be important in a whole host of ways including enhanced network resilience. The proportional impact of these trends is not yet clear to me.

THEN: Logistics networks have been designed with mindsets relevant to a prior era. Production and distribution efficiencies commonly drive product and placement. The infrastructure and apparatus are built around a high proportion of (and preference for) heavily processed foods with extended shelf life. Large manufacturing plants and distribution centers are prevalent, and efficiencies have been built around bulk shipments, which have often driven product assortment decisions. Lastly, outbound distribution models have been designed by large players to maximize their bottom line relying on fairly predictable demand rather than to respond optimally to consumer on-the-go needs.

NOW: Growing consumer expectations for freshness require shorter farm-to-fork times and distances. There has been major growth in small-footprint urban retail locations, as well as substantial growth in home delivery from online channels (e.g., Blue Apron). “Uber-type” on-demand deliveries in a one- to four-hour timeframe have also come to market... There is growth in nontraditional retail and foodservice channels (e.g., limited-assortment and fresh-format stores, specialized chains). Convenience retailers are actively working to deliver a broader, fresher and better variety of prepared foods to customers. Emerging channels like food trucks and farmers markets with unique offerings are also developing; many are harnessing the power of social media to reach consumers.

IMPLICATIONS: This will radically impact food industry logistics.... The increasing need to be closer to customers necessitates additional brick-and-mortar facilities (e.g., distribution centers, cross docks). To speed up cycle time even further, robots, automation and advanced technologies will be required.

I agree this is happening. I agree it could be important in a whole host of ways including enhanced network resilience. The proportional impact of these trends is not yet clear to me.

9.07.2015

The September issue of Supermarket News compares mobile options in the Big Apple. It can be a bit confusing. Not exactly apples and oranges. More like comparing priced-by-the-ounce or by the quart or bushel.

9.01.2015

Above is one 2014 effort to map Amazon fulfillment centers

According to the Wall Street Journal:

A Cuisinart warehoused in California may no longer qualify for two-day shipping to a Prime member in Vermont. That’s the idea behind a new program Amazon is testing with some independent merchants.

The program, nicknamed Ship by Region, lets certain sellers designate where they’re willing to ship goods in two days or less to Prime members.

The merchants may limit how far they will ship some items – large-screen televisions, for example – with the two-day guarantee under Prime. If a Prime customer is outside that region, shipping may take longer.

Physics is still a factor. Time can be compressed. Space can be bent. But the energy required is better spent on dense, proximate concentrations.

Did you see, by the way, the Amazon patent application for their particular use of public transit for deliveries? Here it is.

8.31.2015

The California Supply Chain Transparency Act became law in 2010. Most of the law's requirements became effective on January 1, 2012.

Legislative intent focused on reducing slave labor and human trafficking in supply chains. Companies operating in California with annual revenues of more than $100 million are required to disclose how they (1) engage in verification of product supply chains to evaluate and address risks of human trafficking and slavery; (2) conduct audits of suppliers; (3) require direct supplies to certify that materials incorporated into the product comply with the laws regarding slavery and human trafficking of the countries in which they are doing business; (4) maintain accountability standards and procedures for employees or contractors that fail to meet company standards regarding slavery and human trafficking; and (5) provide employees and management training on slavery and human trafficking.

The complaint in the new Costco case spends about 40 of its 50 pages alleging that slave labor exists in certain fishing areas of Southeast Asia. About half of those pages are replete with photographs and quotations from multinational media and NGO documentaries and commentaries – about slavery, not about Costco...

And then, in what will be both a theme and an organizing principle in this new sort of litigation, the complaint boldly alleges a short sentence 42 pages into the depiction of a centuries’ old problem that multiple governments and NGOs are combating – that “Costco could remedy this situation by enforcing its supplier standards, which prohibit slave labor and human trafficking.”

Legislative intent focused on reducing slave labor and human trafficking in supply chains. Companies operating in California with annual revenues of more than $100 million are required to disclose how they (1) engage in verification of product supply chains to evaluate and address risks of human trafficking and slavery; (2) conduct audits of suppliers; (3) require direct supplies to certify that materials incorporated into the product comply with the laws regarding slavery and human trafficking of the countries in which they are doing business; (4) maintain accountability standards and procedures for employees or contractors that fail to meet company standards regarding slavery and human trafficking; and (5) provide employees and management training on slavery and human trafficking.

Earlier this month the first class-action lawsuit was filed under the Act. According to the National Law Review:

And then, in what will be both a theme and an organizing principle in this new sort of litigation, the complaint boldly alleges a short sentence 42 pages into the depiction of a centuries’ old problem that multiple governments and NGOs are combating – that “Costco could remedy this situation by enforcing its supplier standards, which prohibit slave labor and human trafficking.”

Is it a supply chain where each link is under the control of individually responsible parties? Or is the supply-and-demand network a commons in which most conceptions of control are either very narrow or delusional? What is the responsibility of apex consumers in the system? How can any such responsibility be most effectively exercised?

8.28.2015

I've been traveling too much, hence the absence of new posts. But travel teaches. Last week I landed in Chicago where gasoline was selling at about $3.50 per gallon compared with about $2.35 in Virginia.

The cause was an unexpected maintenance issue at a big BP refinery in Whiting, Indiana. After two weeks offline, the refinery was close to full capacity this Tuesday and prices are beginning to adjust.

Petroleum prices have recently been at a six year low and prices-at-the-pump across most of the nation reflect abundant supply. Except where cheap product cannot be processed.

In California a February explosion at an Exxon refinery in Torrance that usually accounts for ten percent of the state's output has continued to suppress availability. Gasoline prices in LA are even higher than Chicago.

According to the Wall Street Journal:

Supplies also are getting tight along the U.S. East Coast as a large fire broke out at a Delaware City refinery on Friday and operational problems cut into fuel production at plants in New Jersey and Pennsylvania, according analysts.

After running full-tilt for more than a year, American refineries appear to be hitting their limits, said Sandy Fielden, an analyst at energy market researcher RBN Energy LLC.

“Refiners have been running plants hell-for-leather to take advantage of strong margins,” he said. “It stands to reason that if you run any sophisticated plant harder and faster than normal—you are bound to end up breaking something.”

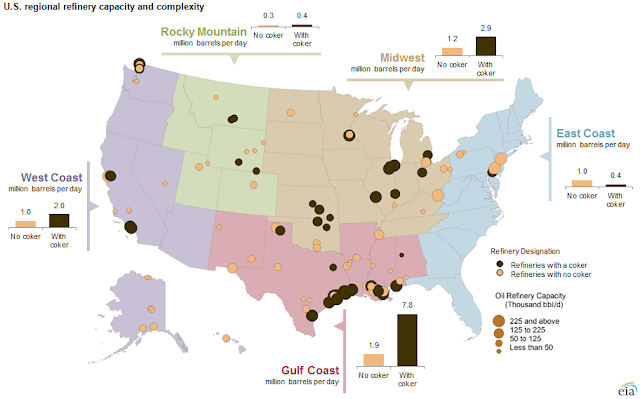

There are 140 refineries -- of various capacities -- in the United States. The map shows their locations (More from EIA). As with most products, availability is a function of production, processing, and transportation. Interruption at any point reduces actual supply.

8.20.2015

On the cusp of the back-to-school season and well-before the traditional surge for the holidays, trucking volumes popped during July. According to the American Trucking Associations:

The advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.8% in July, following a revised drop of 0.4% during June. In July, the index equaled 135.0 (2000=100), the second highest level on record. The all-time high of 135.8 was reached in January 2015.

And even as demand for trucking increases, the supply of truckers continues to fall behind. In an August 18 blog post Yossi Sheffi explains why he does not see a near-term solution emerging.

The advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.8% in July, following a revised drop of 0.4% during June. In July, the index equaled 135.0 (2000=100), the second highest level on record. The all-time high of 135.8 was reached in January 2015.

And even as demand for trucking increases, the supply of truckers continues to fall behind. In an August 18 blog post Yossi Sheffi explains why he does not see a near-term solution emerging.

[Additional commentary and links at Homeland Security Watch]

8.18.2015

The Final Project Report from the UK-US Taskforce on Extreme Weather and Global Food System Resilience outlines "urgent" challenges that arise both from shifting weather patterns and from structural characteristics of the global supply chain for food. According to the authors:

We present evidence that the global food system is vulnerable to production shocks caused by extreme weather, and that this risk is growing. Although much more work needs to be done to reduce uncertainty, preliminary analysis of limited existing data suggests that the risk of a 1-in-100 year production shock is likely to increase to 1-in-30 or more by 2040. Additionally, recent studies suggest that our reliance on increasing volumes of global trade, whilst having many benefits, also creates structural vulnerability via a liability to amplify production shocks in some circumstances. Action is therefore needed to improve the resilience of the global food system to weather-related shocks, to mitigate their impact on people.

The report is also a helpful example of the struggle to resolve two contentious intellectual angles on the problem. Is greater resilience more likely to emerge from greater redundancy and centralization or greater diversity and decentralization? I would argue for the latter over the former. But certainly these two binaries do not reflect the full range of choice.

We present evidence that the global food system is vulnerable to production shocks caused by extreme weather, and that this risk is growing. Although much more work needs to be done to reduce uncertainty, preliminary analysis of limited existing data suggests that the risk of a 1-in-100 year production shock is likely to increase to 1-in-30 or more by 2040. Additionally, recent studies suggest that our reliance on increasing volumes of global trade, whilst having many benefits, also creates structural vulnerability via a liability to amplify production shocks in some circumstances. Action is therefore needed to improve the resilience of the global food system to weather-related shocks, to mitigate their impact on people.

The report is also a helpful example of the struggle to resolve two contentious intellectual angles on the problem. Is greater resilience more likely to emerge from greater redundancy and centralization or greater diversity and decentralization? I would argue for the latter over the former. But certainly these two binaries do not reflect the full range of choice.

8.13.2015

Writing online at Forbes Business, Steve Banker has a great column on "The Next Revolution in Supply Chain Management." Read the whole piece.

One key aspect that he sees emerging:

Enhanced risk management capabilities in the control tower. Minutes after a major catastrophe or impactful but less severe event occurs, a company should be able to draw a perimeter around an event epicenter and answer the following questions: What suppliers are included inside the perimeter? What components do I source from them? What products do they go in? Which customers will be impacted? What is my revenue at risk?

I agree. I also agree that today "only a few very large companies with advanced supply chain capabilities moving down [this] road."

Using the same tools that Mr. Banker outlines in his piece, some enterprises -- especially those related to water, food, pharmaceuticals, medical goods, and fuel -- are improving their capability to continue operating inside the perimeter. This is even less common, but especially critical.

8.10.2015

On July 31 UPS and Coyote Logistics announced that Big Brown will buy the Chicago-based logistics/technology company for an eye-popping $1.8 billion. On August 5 XPO, another tech-leading logistics firm, saw its stock price plummet by ten percent in one day. Meanwhile on August 7 Flexport -- a wannabe Uber for ocean freight -- announced a new round of VC funding.

Friday PwC released an overview of Merger and Acquisition activity in transportation and logistics:

Deal activity improved in the T&L sector in 2Q15, as volume and value increased both sequentially and year-over year. Driven by substantial megadeal growth (more than 36 percent compared to 1Q15), average deal value also increased, to $564 million. 2Q15 saw strong megadeal activity (valued at $1 billion or more), with nine deals valued at $23.6 billion, almost 69 percent of deal value for the quarter.

What all this -- and much more freight-sector volatility -- indicates is the expanding role real-time data access and analysis is having and will continue to have on logistics. Rather than just moving stuff, logistics must increasingly anticipate and coordinate movement. As much or more choreography as cartage. Not just logistics, no longer supply chains, but complex adaptive networks of supply and demand.

Friday PwC released an overview of Merger and Acquisition activity in transportation and logistics:

Deal activity improved in the T&L sector in 2Q15, as volume and value increased both sequentially and year-over year. Driven by substantial megadeal growth (more than 36 percent compared to 1Q15), average deal value also increased, to $564 million. 2Q15 saw strong megadeal activity (valued at $1 billion or more), with nine deals valued at $23.6 billion, almost 69 percent of deal value for the quarter.

What all this -- and much more freight-sector volatility -- indicates is the expanding role real-time data access and analysis is having and will continue to have on logistics. Rather than just moving stuff, logistics must increasingly anticipate and coordinate movement. As much or more choreography as cartage. Not just logistics, no longer supply chains, but complex adaptive networks of supply and demand.

8.07.2015

Good Eggs, the VC funded farm-to-fridge online purveyor of locally grown foods, is pulling back from New York, Los Angeles, and New Orleans, to concentrate on the San Francisco Bay market-space.

In a blog post, CEO Rob Spiro explains:

What we didn’t fully understand when we started was that we were creating a new category that required a different approach to supply chains, logistics, and commerce – all of the pieces of getting food from local producers to the kitchens of our customers. It was, and is, complicated, way more complicated than we ever anticipated. We have learned so many lessons, many of them learned “the hard way” by making mistakes and seeing the consequences. As soon as we realize a mistake, we need to correct it, learn from it, and proceed onwards in service of our mission. When building a software business, hard lessons are learned in code and quickly corrected; when building a food and logistics business, hard lessons involve people, and partners, and are very hard to correct.

In a blog post, CEO Rob Spiro explains:

What we didn’t fully understand when we started was that we were creating a new category that required a different approach to supply chains, logistics, and commerce – all of the pieces of getting food from local producers to the kitchens of our customers. It was, and is, complicated, way more complicated than we ever anticipated. We have learned so many lessons, many of them learned “the hard way” by making mistakes and seeing the consequences. As soon as we realize a mistake, we need to correct it, learn from it, and proceed onwards in service of our mission. When building a software business, hard lessons are learned in code and quickly corrected; when building a food and logistics business, hard lessons involve people, and partners, and are very hard to correct.

8.06.2015

In most grocery stores, mass production still claims the most floor-space: Dry, bottled, and canned goods fill the middle of the store. Frozen foods are prepared and packaged in millions of units . So, sadly, are most tomatoes. Minimum quality can be... well, minimum.

Precisely because these are commodity products, price and convenience become the crucial competitive attributes. Home delivery? "Free" home delivery? Amazon Prime? What Sears pioneered and Sam Walton improved, Jeff Bezos is perfecting.

In response many are shifting to a very different game. Rather than mass production: mass customization.

Whole Foods has flipped the floor. Mass produced is restricted to a few narrow aisles, while a peripheral promenade features in-store prepared foods (or in-store finished foods) such as those pictured above. Demand for prepared food is growing at twice the rate of other groceries. (See: War on Big Food)

This trend obviously has implications beyond food (and profound implications for supply chains). July 1858 is often marked as the beginning of mass produced shoes. Have you visited NIKEiD? Or Shoes of Prey?

Soon: Is product curation a form of mass customization?

8.04.2015

MIT professor -- and supply chain consultant -- David Simchi-Levi, is launching a new start-up focused on supply chain analytics. Many of the capabilities are built around the principles outlined in his most recent book: Operation Rules.

• Supply Chain Network Design

• Multi-Echelon Inventory Optimization

• Supply Chain Risk Management (see prior June 28 post)

• Supply Chain Segmentation, a tool to classify and cluster suppliers, customers and more to facilitate predictive analytics.

The cloud-based platform at the core of the new enterprise will feature:

• Multi-Echelon Inventory Optimization

• Supply Chain Risk Management (see prior June 28 post)

• Supply Chain Segmentation, a tool to classify and cluster suppliers, customers and more to facilitate predictive analytics.

See more at Opalytics

8.03.2015

Since at least the arrival of railroads, retail markets in the United States have trended toward standardization and massification. Sears Roebuck & Co., Atlantic & Pacific Tea Company exploited the railway's potential for efficient distribution of large volumes. Sam Walton expanded the size and number of his stores along the network of late Twentieth Century highways.

Amazon is, arguably, the same retail strategy organized around the "Inter-network" provided by modern telecomputing: the glories of the Sears catalog multiplied and expedited for a new technology.

But, at least in the US and other "advanced" economies, we may be nearing the close of comparative advantage derived from the having more and more of the same product-lines at lower prices.

Instead of massification, product curation is emerging as a key differentiation. Certainly this is -- perhaps has always been -- the strategy of the very high end. The strategy is turning down-market.

Last week Whole Foods announced it would go head to head against Trader Joe's with new smaller format stores. This is an early skirmish in a battle for the future of urban grocery.

Soon to appear in affluent urban/suburban neighborhoods near you: many more Aldi's and the first North American Lidl's. Like Trader Joe's (owned by the same German company that owns Aldi's) these stores will carry no more than ten percent of the SKUs as a traditional supermarket. But these are SKU's that are in high and sustainable demand.

Last week also saw A&P re-enter bankruptcy, probably for the last time. The banner that founded no-frills cash-and-carry in 1912 is dying, even as it's original customer-facing format is the new rage. But it is a format with a radically new back-end.

Soon: And more customization.

7.30.2015

Above: If this is an abstraction of supply chain relationships/dependencies, where might the most risk reside?

From the World Economic Forum's 2012 paper, New Models for Addressing Supply Chain and Transport Risk:

Global supply chains and transport networks form the backbone of the global economy, fueling trade, consumption and economic growth. Trends such as globalization, lean processes and the geographical concentration of production have made supply chain networks more efficient, but have also changed their risk profile. Most enterprises have risk management protocols that can address localized disruptions. However, recent high-profile events have highlighted how risks outside the control of individual organizations can have cascading and unintended consequences that cannot be mitigated by one organization alone.

It is not just concentration of production. Concentration is a feature of almost every level of the supply chain and, originates in concentration of demand within increasingly dense urban conglomerations. Demand concentration facilitates other sorts of concentrations. Walmart, Costco, Lowes, Home Depot, Liquor Barn and similar retail strategies concentrate a wide array of products in very close proximity to serve demand. These demand "attractors" are served by large distribution or fulfillment centers that are increasingly clustered around the same transportation networks. Economies of scale support product diversity, considerable convenience, and competitive pricing.

Soon: Will the supply concentration strategy be superseded by a capacity for"mass-customization"?

7.29.2015

Above: Green shows Indianapolis food deserts in 2014, by Indiana Public Media.

Last year at least one analysis found Indianapolis to be the US metro area with the most population living in a "food desert".Last week the Indy empty zone got a bit bigger when four long-time grocery stores serving low-income areas suddenly closed.

According to Walk Score seventy-two percent of New Yorkers live within a five minute walk of a grocery outlet with healthy options. Only five percent of Indianapolis residents live within a five minute walk.

Four Double 8 stores had served northern Indianapolis for over a half-century. They closed -- seemingly collapsed -- without much warning. I'm guessing (and that's all it is) that they lost a line-of-credit either with their bank for payroll or with their supplier for products. They had been trying to sell the stores -- without success -- for a time.

The owner/operator of Double 8 pointed to new competitors within a quick drive. The competitors are banners of much bigger chains. While once-upon Double 8 customers told reports that the small chain offered quality products and low prices, the bigger chains can meet the price-points and offer a more diverse range of products, including pharmacy, gasoline, ready-to-eat and more. In most American cities -- unlike New York -- the hassle associated with driving several more blocks is not sufficient to discourage direct competition across almost any 25-to-30 square mile quadrangle. If you have a working vehicle.