I've been traveling too much, hence the absence of new posts. But travel teaches. Last week I landed in Chicago where gasoline was selling at about $3.50 per gallon compared with about $2.35 in Virginia.

The cause was an unexpected maintenance issue at a big BP refinery in Whiting, Indiana. After two weeks offline, the refinery was close to full capacity this Tuesday and prices are beginning to adjust.

Petroleum prices have recently been at a six year low and prices-at-the-pump across most of the nation reflect abundant supply. Except where cheap product cannot be processed.

In California a February explosion at an Exxon refinery in Torrance that usually accounts for ten percent of the state's output has continued to suppress availability. Gasoline prices in LA are even higher than Chicago.

According to the Wall Street Journal:

Supplies also are getting tight along the U.S. East Coast as a large fire broke out at a Delaware City refinery on Friday and operational problems cut into fuel production at plants in New Jersey and Pennsylvania, according analysts.

After running full-tilt for more than a year, American refineries appear to be hitting their limits, said Sandy Fielden, an analyst at energy market researcher RBN Energy LLC.

“Refiners have been running plants hell-for-leather to take advantage of strong margins,” he said. “It stands to reason that if you run any sophisticated plant harder and faster than normal—you are bound to end up breaking something.”

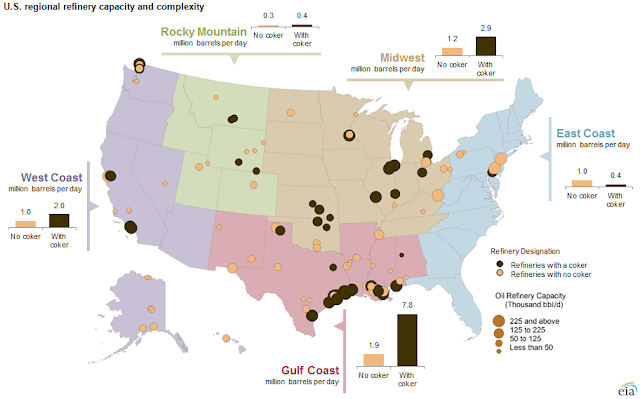

There are 140 refineries -- of various capacities -- in the United States. The map shows their locations (More from EIA). As with most products, availability is a function of production, processing, and transportation. Interruption at any point reduces actual supply.

No comments:

Post a Comment